Guest Post By: Ronald Uy, pet insurance contributor at consumersadvocate.org

Two of the most important questions to ask when shopping for any type of pet insurance are: What does it cover? and How much is it going to save me? After all, it’s no use having pet insurance during an emergency when it’s only good on paper.

Pet insurance is estimated to cost guardians hundreds of dollars annually. This can be expensive and many people would rather spend the money on keeping their four-legged family members healthy and happy. While this might work with younger pups in their prime, pet guardians should also think ahead to the future.

Your Pets Age: When Should I Enroll Them?

Just like their two-legged parents, insuring pets when they’re young and healthy is cheaper. You might think that skipping a few years of paying premiums when your pets are young could save you money. However, actual average costs of premiums throughout the life of the plan for pets enrolled when they are young is lower when compared to enrolling older pets.

The risk of older pets suffering from illnesses or medical conditions is not lost in the minds of pet insurance companies. By enrolling your pets when they are young and healthy, you can lock-in cheaper premiums throughout the life of your policy.

Pre-existing conditions – another thing to remember is that some pet insurance companies do not include pre-existing conditions in their list of coverage. And the older you enroll your pet, the more likelihood of them suffering from one of these medical conditions. Enrolling your pet early makes it possible for you to include these ailments in the unfortunate event that your pet suffers from these conditions down the road.

Coverage: What Does It Pay For?

Again, there’s no sense having pet insurance if it’s only good on paper. Knowing that your pet insurance policy will be there in an emergency or serious medical condition is more important compared to how much your monthly premiums are costing you.

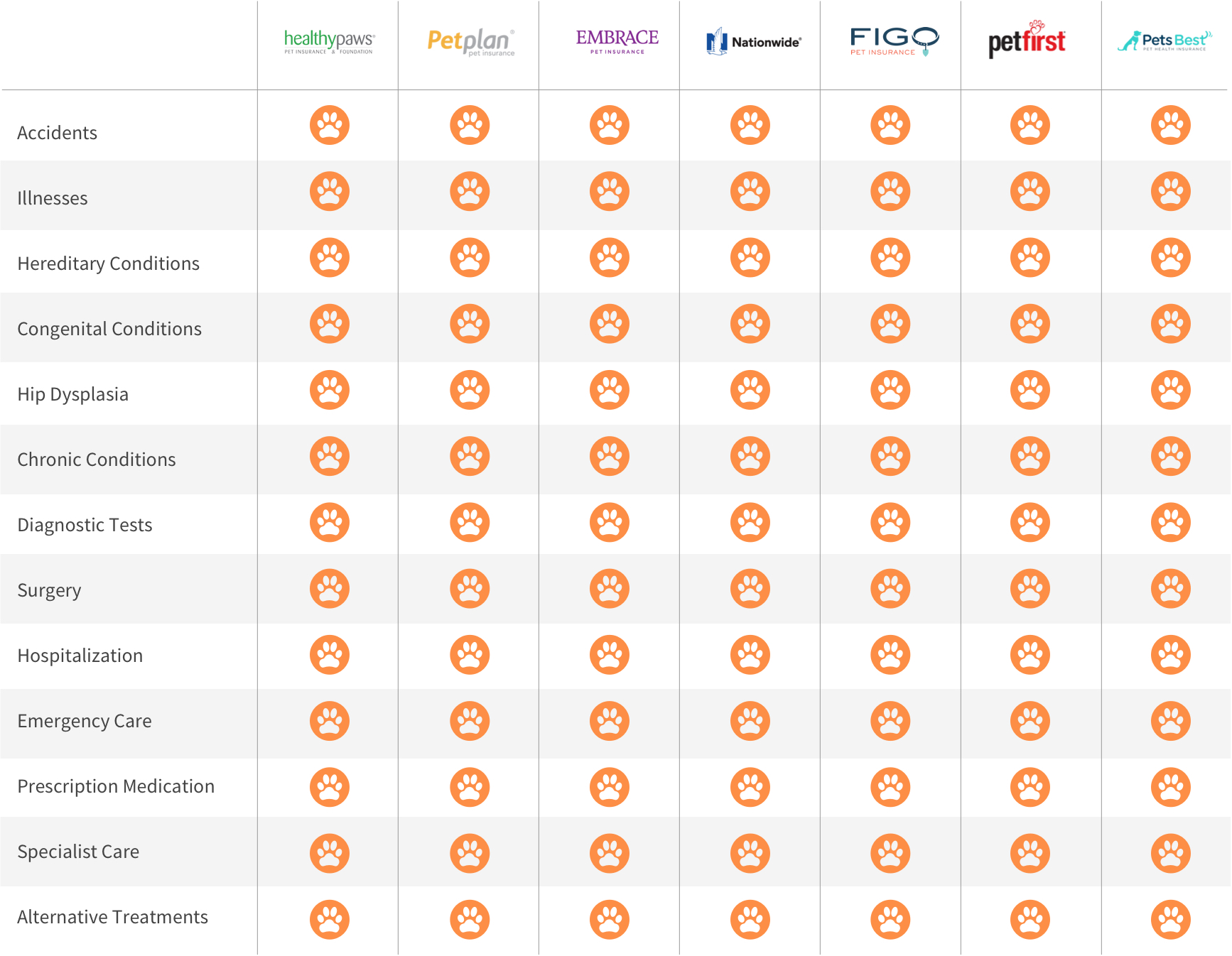

Covered Conditions – The best pet insurance plans cover almost any medical condition and illnesses. When shopping for pet insurance and checking coverage, it’s essential to know what conditions your dog’s breed is most likely to develop and suffer from.

Covered Treatments – The next thing to check is what type of treatments the policy covers. For example, your pet insurance may include cancer, but if it doesn’t include all possible cancer treatments then you’re not quite getting the full value of your policy. Your policy should include coverage for lab tests, hospitalization, medications, exams, surgery and even emergency care.

Terms To Know When Looking For Insurance:

- Accident waiting period – This is the amount of time before a policyholder can make a claim for accidents. Accident waiting periods are generally shorter compared to illness waiting periods and usually take effect within 24 hours.

- Illness waiting period – commonly runs for 30 days, but can go as quickly as 15 days. Benefit limits do not take effect until the illness waiting period is satisfied.

Benefit Limits: How Much Does It Save You?

After determining coverage, the next thing to look out for is how much does your policy pay for. There are four general types of benefit limits:

- Unlimited Lifetime

- Annual Maximum

- Annual Per Incident

- Lifetime Maximum

Policies with Annual Maximum, Annual Per Incident, and Lifetime Maximum have a cap on how much your policy pays for a specific period. Annual benefit types have a clear cap on how much it pays in a year and benefit limits are only reset the following year.

Unlimited Lifetime limits do not place any caps on how much a policy pays within a year. This is ideal for pets suffering from chronic illnesses. Pets suffering from cancer, for example, can continue to receive benefits throughout the life of the policy.

Deductibles and Co-payments: How Much Do I Pay for Each Treatment?

Deductibles should not be confused with co-payments. Your plan’s deductible is the amount of money to be paid out of pocket before the pet insurance company starts paying. A pet insurance policy with a $500 deductible, for example, requires the policyholder to shoulder all initial payments of up to $500 before the benefit limits kick in.

Co-payments, on the other hand, is the percentage of the vet bill that a policyholder pays. This is based on the pet insurance plan’s reimbursement model. A plan with a 90% reimbursement model pays for 90% of treatments.

Premiums: How Much Is It Going To Cost Me?

After reviewing all the factors that should be considered when shopping for pet insurance, this is the best time to start crunching numbers. Higher deductibles translate to lower premiums. Plans with higher benefit limits also demand higher premiums.

We highly recommend pet insurance policies with unlimited lifetime benefits. This might come with higher premiums, but the benefits of having these down the road far outweigh its initial costs. Enrolling your pets earlier could also save you hundreds of dollars in yearly premiums.

So … Should You Have Pet Insurance?

Some of us would consider saving money for our pets a more economical approach compared to paying for pet insurance. Saving for a rainy day is something that you can do if you can accurately predict your pet’s health years down the road. But what happens if your pet gets into an accident or suffers from a serious medical condition?

Much more than the costs, the real benefit of having pet insurance is the peace of mind knowing your pet can get the best medical treatment, which is priceless for pet parents who only wish the best for their pets.

About The Author:

Ronald Uy is a researcher and regular contributor for pet insurance at ConsumersAdvocate.org. When not writing, he’s busy planning his next adventure or heading out to the beach with Lucy, a 5-year-old beagle.